Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through filing your Articles of Organization with the New Mexico Secretary of State. This is the document that officially forms your New Mexico LLC.

The only way to form a New Mexico LLC is by filing online.

The state no longer accepts mail filings. This is due to Senate Bill 167 that went into effect in July 2019.

If you don’t want to file your LLC online, you could hire a company to form your LLC instead. Check out Best LLC Services in New Mexico for our recommendations.

Forming a New Mexico LLC costs $50. This is a one-time filing fee that is paid to the state.

Note: The “LLC filing fee” (the fee to create a New Mexico LLC) is the same thing as the “Articles of Organization fee”. The Articles of Organization is the document, that once approved by the Secretary of State’s office, creates your New Mexico LLC.

How much is an LLC in New Mexico explains all the fees you’ll pay, including the Articles of Organization filing fee.

It takes 1-3 business days for your New Mexico LLC to be approved. The state will send you an email as soon as your LLC is approved.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in New Mexico.

Before forming your New Mexico LLC, make sure you have read the prior two lessons:

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

If you don’t have an online account with the New Mexico Secretary of State, you’ll first need to create one:

You will likely see a pop-up message that says “Our credit card process has changed!”

In order to pay for your LLC filing online, you first must add money to your account (called your “prepaid account”) using your credit card. Then at the end of the online filing, you will choose to pay with your prepaid account.

The state requires that you pay this way for enhanced credit card security and the safety of your information.

Now, back in your online dashboard, you’re ready to begin the online New Mexico LLC filing.

Hover your mouse over “Corporations” (in the top left menu), then click “Domestic (NM) LLC Formation”.

Make sure “Domestic Limited Liability Company” is selected from the drop down menu (it should be the only option).

Enter your desired LLC name exactly as you would like it.

Make sure to include the designator (ending). As per Section 53-19-3 of the New Mexico LLC Act, the following designators are allowed:

Capitalization:

Make sure to use your preferred capitalization, such as uppercase and lowercase letters. There is no set rule here, so you can use uppercase and lowercase letters however you’d like.

Comma:

You can use a comma in your LLC name or leave it out.

For example: “ABC Widgets, LLC” and “ABC Widgets LLC” are both acceptable.

How to avoid a rejected LLC filing:

The most common reason LLC filings are rejected in New Mexico is because the LLC name isn’t available. Make sure you read the New Mexico LLC Name lesson before proceeding with your online filing.

If you want your LLC to go into existence on the date it’s filed with the Secretary of State, leave the date as-is (today’s date should be auto-filled).

If you want your LLC to go into existence at a later date, select that date from the calendar. This date cannot be more than 90 days ahead.

Tip: If you’re forming your LLC later in the year (October, November, or December), and you don’t need your LLC open right away, you can forward date your filing to January 1st of the following year. This will save you the hassle of filing taxes for those 1-3 months.

In this section, you need to let the New Mexico Secretary of State know about the duration of your LLC (how long it will remain in existence).

If you prefer for your LLC to be “open-ended” with no set closure date, select “Perpetual“.

If you prefer for your LLC to be automatically shut down on a specific date in the future, select “The period of duration is” and enter the following time frame of existence: years, months, and days, as well as the date of dissolution by selecting the date from the calendar button.

Tip: Most people select “Perpetual” as this gives them the freedom to run their LLC for as long as they like. And if they decide to shut down the LLC in the future, they can do so by filing dissolution paperwork with the state.

In this section, you can list a general business purpose or you can list a specific purpose for your LLC. Listing a specific purpose is optional.

General business purpose:

Just leave this section blank if you’d like for your LLC to have a general business purpose.

Specific business purpose:

NAICS Codes (North American Industry Classification System) are used by government agencies to identify your New Mexico LLC’s line of business and activities.

If you’d like to list the specific purpose of your LLC, select your NAICS Code and Subcode from the drop down menus. If you don’t see your exact industry, you can just select the closest thing to it.

Then in the “Business Purpose” box, enter a few words or a sentence about what your business does. It doesn’t have to be extremely specific, and you are not going to be forced to do this forever. You can always change the purpose of your business at any time.

You can enter just a few words, (ex: “pizza shop”, “real estate investing”, “landscaping”, etc.), or a short sentence (ex: “restoration of old cars”, “life coaching services and products”, etc.).

Tip: Many filers choose a general business purpose for the most flexibility.

Click the “Continue” button to proceed.

If you hired a Commercial Registered Agent:

Note: If you hired Northwest Registered Agent, search for “Northwest Registered Agent”. Then select “Northwest Registered Agent, Inc.” as this is their official company name in New Mexico.

If your Registered Agent is an individual (ex: you, friend, family):

This section is optional so you can leave it blank if you’d like.

If you prefer to enter an email address and phone number for your LLC, you can do so here. The email address can be any email address. The phone number can be any phone number.

Tip: Most people leave this blank for privacy reasons as this information may appear on public record.

Enter your LLC’s Principal Place of Business. This address can be located in New Mexico, but it doesn’t have to be. It can be located in any state. It can also be located in another country.

Your Principal Place of Business is your LLC’s location (or where you keep business and LLC paperwork).

This can be a home address, a friend or family member’s address, an office address, or the address of your Registered Agent (if allowed).

Note: If you hired Northwest Registered Agent, they allow you to use their address as your LLC’s Principal Place of Business. This allows you to keep your address off public record. They also allow you to use their address throughout the rest of your LLC filing.

If you’re going to use the address of your Registered Agent, check off “Same as Registered Agent Physical Address”.

This section is optional, so if your LLC doesn’t have a mailing address that is different than its Principal Place of Business, you can leave this blank.

If you’d like to receive mail at an address different than listed above, you can enter that address here. This address can be located in New Mexico, but it doesn’t have to be. This address can be located in any state.

Click the “Continue” button at the bottom to proceed.

Note: If you see a pop-up message that says “Please use the principal place of business in New Mexico in the DLLC address change flow online”, you can ignore it. It’s not important. Just click “Okay” if you see a pop-up message.

Member -managed LLC:

If your LLC will be Member -managed, select “No”.

Note: You don’t need to click the “Add Manager” button.

Manager -managed LLC:

If your LLC will be Manager -managed, select “Yes”.

Then click the “Add Manager” button and add the manager’s contact information. Click “Add” to save.

Tip: Most LLCs in New Mexico are Member -managed. However, for more information on LLC management, please see the related article above.

Single-Member LLC (just 1 Member):

Select “Yes”.

Multi-Member LLC (2 or more Members):

Select “No”.

“Add Member” button:

Adding Members (owners) to your Articles of Organization filing is optional.

You can skip this step or click “Add Member” to add the LLC Members to the Articles of Organization.

Note: If Members are added, that information will be a part of the LLC’s filing and will be on public record.

Click “Continue” to proceed.

An LLC Organizer is the person (or company) who files the Articles of Organization with the Secretary of State.

Being an LLC Organizer doesn’t automatically make someone a Member (owner) of an LLC.

That said, most LLC owners file their own Articles of Organization, so it’s often true that the LLC Organizer is also an LLC Member.

To add an LLC Organizer to the filing (required), click the “Add Organizer” button, enter their contact information, and then click the “Add” button to save.

Important: Check off the little box under the “Authorized By” column (it’s to the right of the Organizer’s information). This means that this Organizer will be electronically signing the form. This will also auto-populate their name under the “Authorizer Name” in the Certify section below.

You next to upload a signed consent form showing that your Registered Agent agrees to be the Registered Agent for your LLC.

If you or someone you know will be your Registered Agent:

You/they will only need to complete Box 1 (leave Box 2 blank). Enter the Registered Agent’s name on the first line, the LLC’s name on the second line, and then sign on the third line.

Next, scan the form to your computer and save in PDF format. And then upload it here in the online filing.

If you hire a Registered Agent:

You’ll need to contact them or look in your online account for a signed form. Once they send you the signed form, you can upload it here in the online filing.

You can skip this section unless you have a specific attachment you need to include with your LLC filing.

There is nothing to complete in this section. Today’s date will automatically be entered and it cannot be changed.

Click “Continue” to proceed.

Review your information for accuracy and check for any typos.

If you need to make any changes, click the “Edit” button to the right of any section.

If everything looks good, click “Continue” to proceed.

Select “I wish to pay by Prepaid account”.

Click “Pay Securely using My Prepaid Account” and complete the checkout process.

Congratulations, your New Mexico LLC has been filed for processing!

Now you just need to wait for approval.

Your New Mexico LLC will be approved in 1-3 business days.

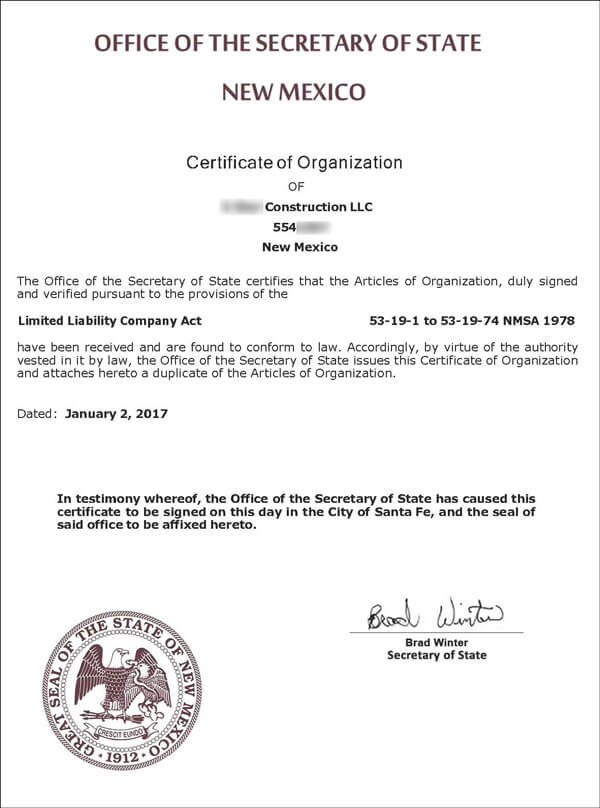

Once your LLC is approved, the New Mexico Secretary of State will send you an email with the following documents:

Note: You’ll use the above documents and your LLC’s EIN Number to open an LLC bank account.

Here’s an example of what the New Mexico Certificate of Organization will look like:

If you have any questions, you can contact the New Mexico Secretary of State at 505-827-3600.

Their hours are Monday through Friday from 8am to 5pm (Mountain Time).

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name